Yearly depreciation formula

For an asset with a five-year useful life you would use 15 as the denominator 1 2 3 4 5. Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value To calculate this value on a monthly basis divide the result by 12.

Depreciation Rate Formula Examples How To Calculate

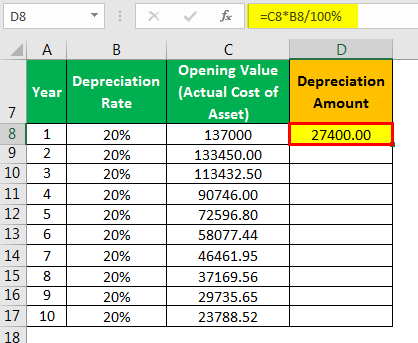

The depreciation base is constant throughout the years and is calculated as follows.

. This rate is consistent from year to year if the straight-line method is used. He depreciates the patent under the straight line method using a 17-year useful life and no salvage value. Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation 10000-10005 90005 1800year Annual Depreciation Rate.

Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. For example the total depreciation for 2023 is comprised of the 60k of depreciation from Year 1 61k of depreciation from Year 2 and then 62k of depreciation from Year 3 which. If you want to assume.

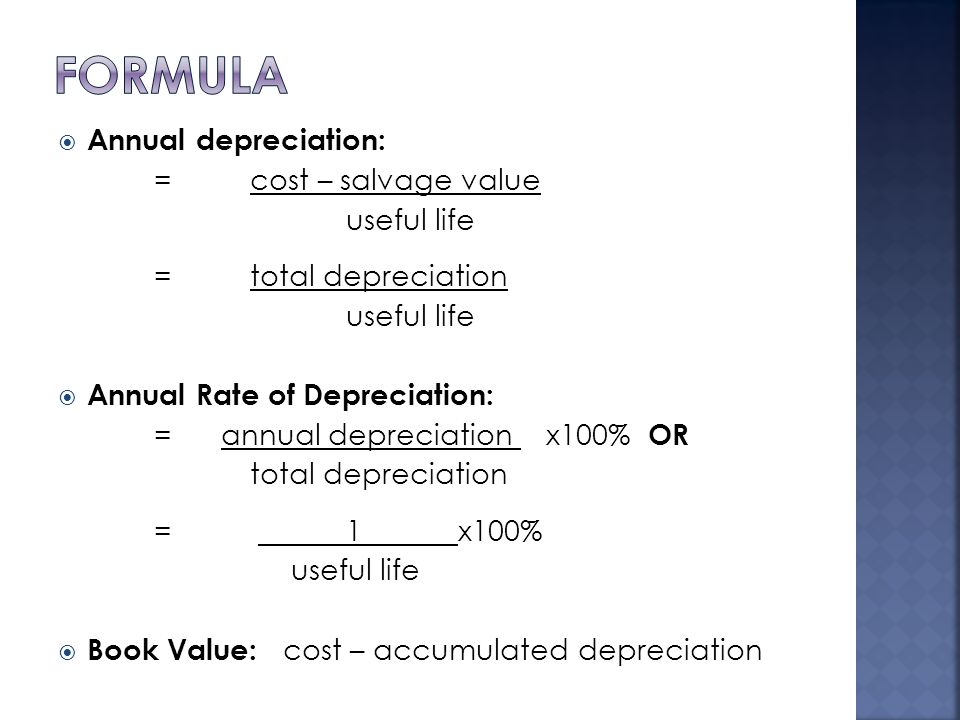

Sinking fund or Depreciation. In the first year multiply the assets cost basis by 515 to find the annual. Annual depreciation is the standard yearly rate at which depreciation is charged to a fixed asset.

In April Frank bought a patent for 5100 that is not a section 197 intangible. The syntax is SYD cost salvage life per with per defined as. For example 25000 x 25 6250 depreciation expense.

Annual Depreciation Cost of Asset Net Scrap ValueUseful Life Annual Depreciation. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. The SYD function calculates the sum - of - years digits depreciation and adds a fourth required argument per.

Under the SYD method the depreciation rate percentage for each year is calculated as the number of years in remaining asset life for the. Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12. Total Depreciation - The total amount of depreciation based upon the difference.

Multiply the rate of depreciation by the beginning book value to determine the expense for that year. Annual depreciation Depreciation factor x 1Lifespan x Remaining book value Of course to convert this from annual to monthly depreciation simply divide this result by 12.

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Accumulated Depreciation Definition Formula Calculation

Depreciation Rate Formula Examples How To Calculate

Gt10103 Business Mathematics Ppt Download

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation And Book Value Calculations Youtube

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Method Of Depreciation Accounting Corner

Straight Line Depreciation Formula Guide To Calculate Depreciation

Double Declining Balance Method Of Depreciation Accounting Corner

Macrs Depreciation Calculator With Formula Nerd Counter

Ex Find Annual Depreciation Rate Given F T Ae Kt Youtube